Berkshire Grey Press

Berkshire Grey Reports Third Quarter 2021 Results

Total Orders to-Date Increase to $184 Million, Reinforcing the Company’s Ongoing Revenue Momentum and Growth Trajectory

BEDFORD, Mass., November 11, 2021—Berkshire Grey Inc. (Nasdaq: BGRY), a leader in AI-enabled robotic solutions that automate supply chain processes, today announced results for its third quarter ended September 30, 2021.

Third Quarter and Recent Financial Highlights

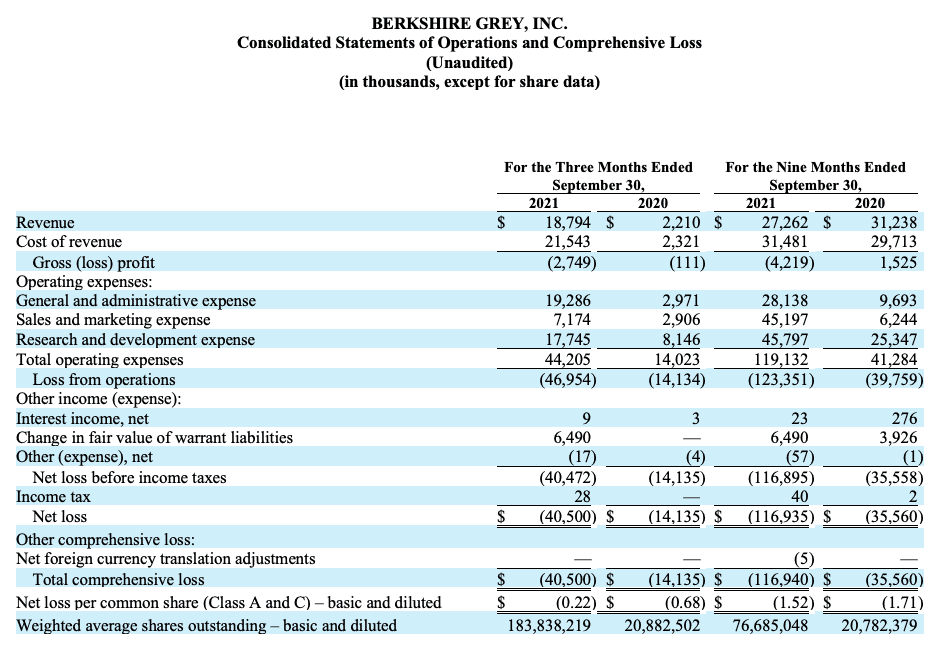

- Revenue of $18.8 million in the third quarter 2021, an increase of $16.6 million or 750% from the third quarter of 2020 and an increase of $14.3 million or 317% from the second quarter of 2021.

- Total orders since inception of $184 million including orders received in early October identified below. The Company has received $70 million in new orders in 2021 year-to-date.

- Backlog of $113 million including orders received in early October, compared to $70 million as of December 31, 2020.

- Net loss of $40.5 million or $(0.22) per diluted share in the third quarter of 2021.

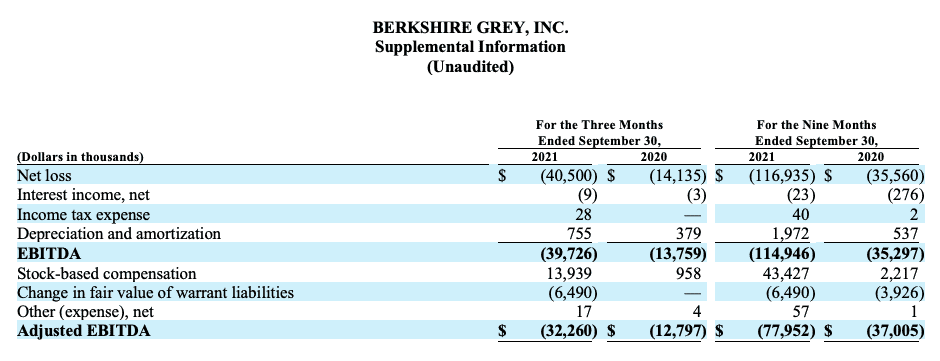

- Adjusted EBITDA of $(32.3) million in the third quarter of 2021.

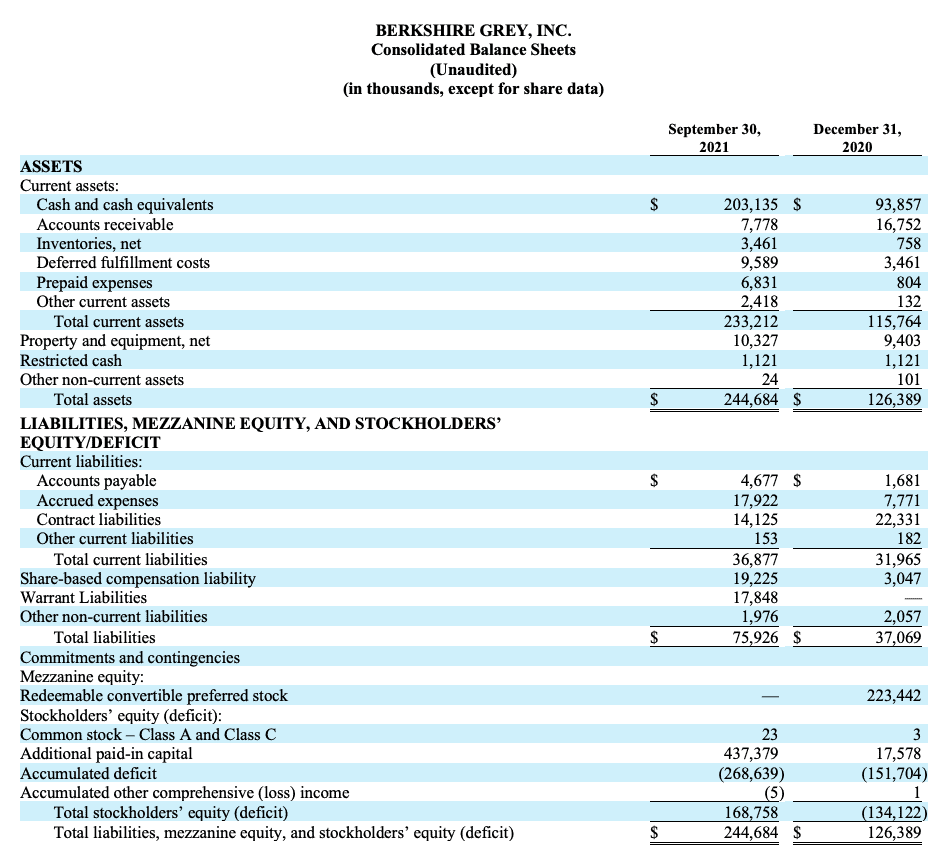

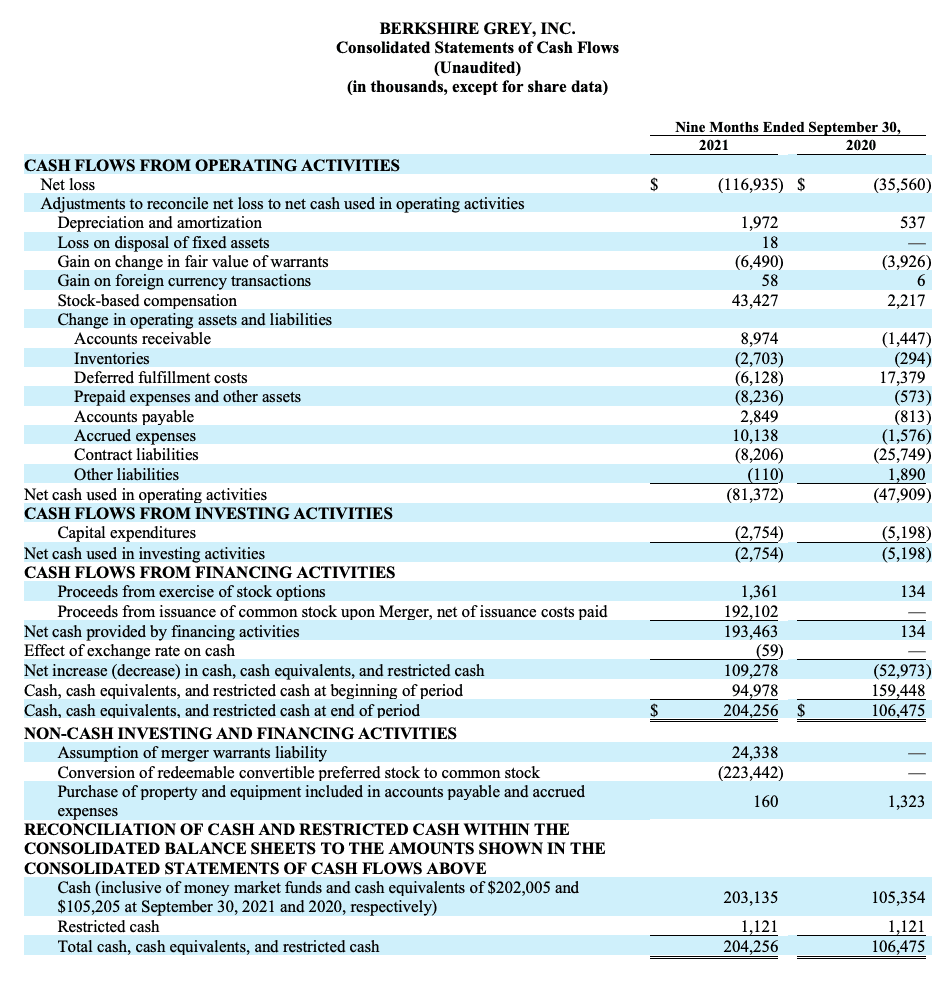

- Solid liquidity position, ending the quarter with $203 million of cash and no debt.

Third Quarter 2021 and Recent Business Highlights

- Secured a $25 million repeat order from a blue-chip anchor customer for tens of the Company’s eCommerce package handling systems. These systems will go into multiple locations and there are many locations left to automate.

- Secured $11 million in orders from new customers.

- Advanced its Berkshire Grey Partner Alliance (BGPA) program which now includes nine partners. The BGPA program includes a select group of market-leading consultants, integrators, technology providers and material handling leaders, broadening the Company’s global reach and extending its go-to-market strategy.

- Announced the global availability of its Robotic Pick and Pack (RPP) solutions which automates picking and packing of items directly from inventory totes to outbound customer shipping packages, improving operation efficiency for fulfillment centers, reducing shipping costs and lowering the environmental impact of eCommerce orders.

- Launched its AI-powered Robotic Shuttle Put Wall (RSPW) solution for eCommerce order fulfillment. The RSPW is an automated put wall that increases customer order sortation throughput by up to 300% and can accommodate up to 100% of typical SKU assortments, including challenging items such as soft polybags and cylinders/tubes.

- Partnered with United Way to donate learning kits to Boston Public School (BPS) students as part of the Berkshire Grey Picking with Purpose program, which serves vulnerable populations by using its intelligent robotic sortation solutions to assemble meals and essential goods to communities in need.

- Completed its business combination with Revolution Acceleration Acquisition Corp. and began trading under the ticker symbol “BGRY” on the Nasdaq Stock Exchange (Nasdaq) on July 22, 2021, as the first and only publicly traded, pure-play Intelligent Enterprise Robotics company that provides complete, AI-enabled automation of picking, mobility and system orchestration for eCommerce order fulfillment, retail and grocery resupply and package handling.

- Grew the organization to approximately 400 employees as of September 30, 2021, an increase of approximately 160 from December 31, 2020, reflecting the Company’s investments in sales, marketing, engineering, and operations.

“Overall, we are excited by both our progress this year and that it aligns with our long-term trajectory. The macros around the business are strong, we are proven and seeing repeat orders from blue-chip anchor customers according to plan, we are adding new customers through direct sales and partnering into the larger ecosystem,” said Tom Wagner, CEO, Berkshire Grey Inc. “Orders through early October are $70 million and we have $184 million in orders to date. Great progress from our perspective and this is only the beginning.”

Outlook

Berkshire Grey’s outlook is based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Information Regarding Forward-Looking Statements” below. Berkshire Grey expects revenue for the full year 2021 to be approximately $50 million.

Conference Call and Webcast Information

Berkshire Grey will hold a conference call and webcast today at 10:00 am ET to discuss its third quarter 2021 results. The telephonic version of the call can be accessed by dialing:

Toll-free dial-in number: (855) 639-2214

International dial-in number: (409) 216-0598

Conference ID: 4665177

The live webcast of the call will be accessible on the Company’s website at https://ir.berkshiregrey.com/ approximately two hours after conclusion of the live event, an archived webcast of the conference call will be accessible from the Investor Relations section of the Company’s website for twelve months.

About Berkshire Grey

Berkshire Grey (Nasdaq: BGRY) helps customers radically change the essential way they do business by delivering game-changing technology that combines AI and robotics to automate fulfillment, supply chain, and logistics operations. Berkshire Grey solutions are a fundamental engine of change that transform pick, pack, move, store, organize, and sort operations to deliver competitive advantage for enterprises serving today’s connected consumers. Berkshire Grey customers include Global 100 retailers and logistics service providers. More information is available at www.berkshiregrey.com.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including EBITDA and Adjusted EBITDA. We define Adjusted EBITDA, a non-GAAP financial measure, as net loss less other income or expense, income taxes, depreciation and amortization expense, changes in the fair value of warrants liabilities, and stock-based compensation expense. In addition to our financial results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we believe that Adjusted EBITDA, a non-GAAP financial measure, is useful in evaluating the performance of our business because it highlights trends in our core business. This non-GAAP measure has limitations as an analytical tool. We do not, nor do we suggest that investors should, consider any non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors should also note that the non-GAAP financial measures we use may not be the same non-GAAP financial measures, and may not be calculated in the same manner, as that of other companies. We recommend that investors review the reconciliation of this non-GAAP measure to the most directly comparable GAAP financial measure provided in the financial statement tables included below in this press release, and not rely on any single financial measure to evaluate our business.

Cautionary Information Regarding Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be made directly or indirectly in this communication. All forward-looking statements are based upon management estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Berkshire Grey as of the date of this communication, including but not limited to, our beliefs regarding our operating performance, including our outlook and guidance for the full year 2021, and demand for our solutions in general. Any such estimates, assumptions, expectations, forecasts, views or opinions set forth in this communication constitute Berkshire Grey’s judgments and should be regarded as indicative, preliminary and for illustrative purposes only. These forward-looking statements are subject to numerous risks, including, without limitation, the following: the expected benefits from the Business Combination; our plans to develop and commercialize its product candidates; our ability to continue to develop new innovations to meet constantly evolving customer demands; our expectations regarding the impact of the ongoing COVID-19 pandemic on its business, industry and the economy; our estimates regarding future expenses, revenue, earnings, margin, capital requirements and needs for additional financing after the Business Combination; our expectations regarding the growth of our business, including the potential size of the total addressable market; our ability to maintain and establish collaborations or obtain additional funding; our ability, subsequent to the consummation of the PIPE Investment and the Business Combination, to obtain funding for our future operations and working capital requirements and expectations regarding the sufficiency of our capital resources; the implementation of our business model and strategic plans for our business following the Business Combination; our intellectual property position and the duration of our patent rights; developments or disputes concerning our intellectual property or other proprietary rights; our ability to compete in the markets we serve; our expectations regarding our entry into new markets; competition in our industry, the advantages of our solutions and technology over competing products and technology existing in the market and competitive factors including with respect to technological capabilities, cost and scalability; the impact of government laws and regulations and liabilities thereunder; our need to hire additional personnel and our ability to attract and retain such personnel; our ability to raise financing in the future; and the anticipated use of our cash and cash equivalents. The forward-looking statements and projections contained in this communication are subject to a number of factors, risks and uncertainties, some of which are not currently known to Berkshire Grey, that may cause Berkshire Grey’s actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition. Although such forward-looking statements have been made in good faith and are based on assumptions that Berkshire Grey believe to be reasonable, there is no assurance that the expected results will be achieved. Berkshire Grey’s actual results may differ materially from the results discussed in forward-looking statements. Additional information on factors that may cause actual results to differ materially is included in Berkshire Grey’s filings with the Securities and Exchange Commission (the “SEC”). Copies of such filings are available publicly on the SEC’s website at www.sec.gov or may be obtained by contacting Berkshire Grey. Readers are cautioned not to place undue reliance upon any forward-looking statements. These forward-looking statements are made only as of the date hereof, and Berkshire Grey does not undertake any obligations to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Get Started

with Berkshire Grey

Contact the BG Fulfillment Automation Sales Engineering Team to Learn How to:

- Reduce operations expense by up to 70%.

- Lessen your dependency on labor.

- Bolster facility throughput by up to 25% to 50% with automation.

- Get a customized ROI analysis of your specific environment and business.

Call +1 (833) 848-9900

or connect using our form.