Berkshire Grey Press

Berkshire Grey Reports

Third-Quarter 2022 Results

Revenue Up 26% Year-Over-Year To $23.6 million in Q3;

YTD Revenues Up 93%

Completes THE Highest Number of Installations in a Quarter

in Company History

BEDFORD, Mass. – November 14, 2022 – Berkshire Grey Inc. (Nasdaq: BGRY) (the “Company”), a leader in AI-enabled robotic solutions that automate supply chain processes, today announced results for its third quarter ended September 30, 2022.

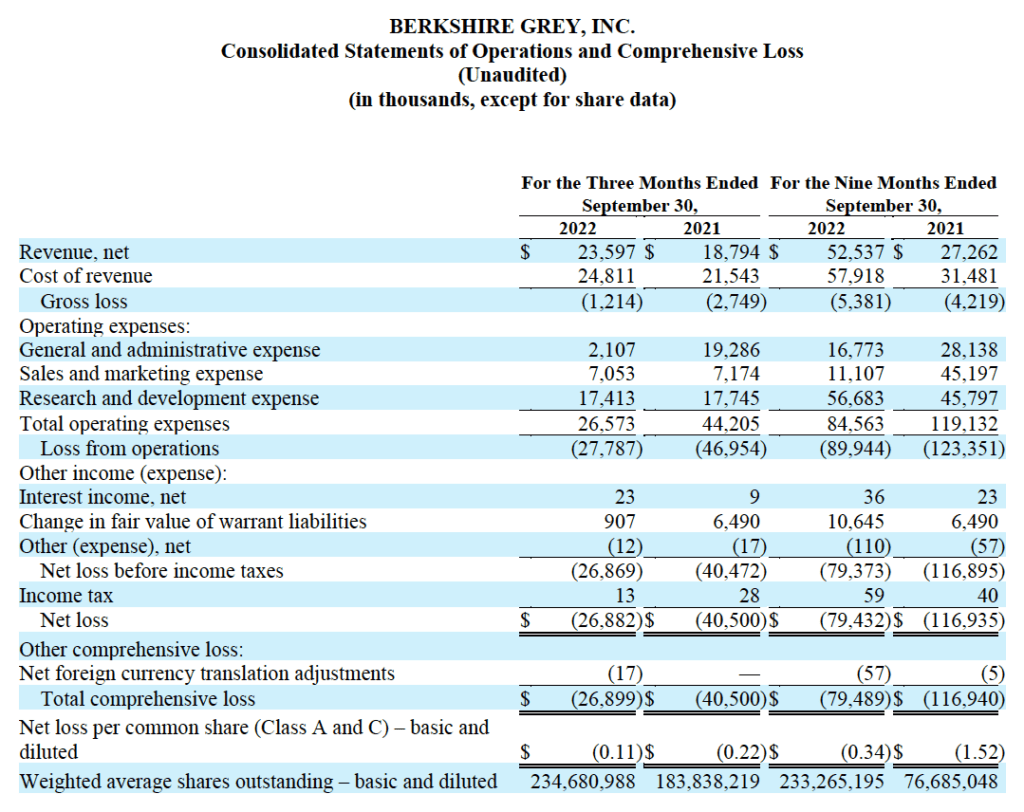

Third-Quarter Financial Highlights

- Revenue of $23.6 million, an increase of 26% compared to the third quarter of 2021. Revenue includes $0.4 million for the provision for common stock warrants, which is recorded as a reduction in revenue.The Company previously issued a warrant to purchase Berkshire Grey common stock in conjunction with the expansion of its strategic relationship with FedEx.

- Year-to-date total orders received through early November of over $50 million.

- Backlog of approximately $104 million, which includes orders through early November.

- Net loss of $26.9 million, or $0.11 per share.

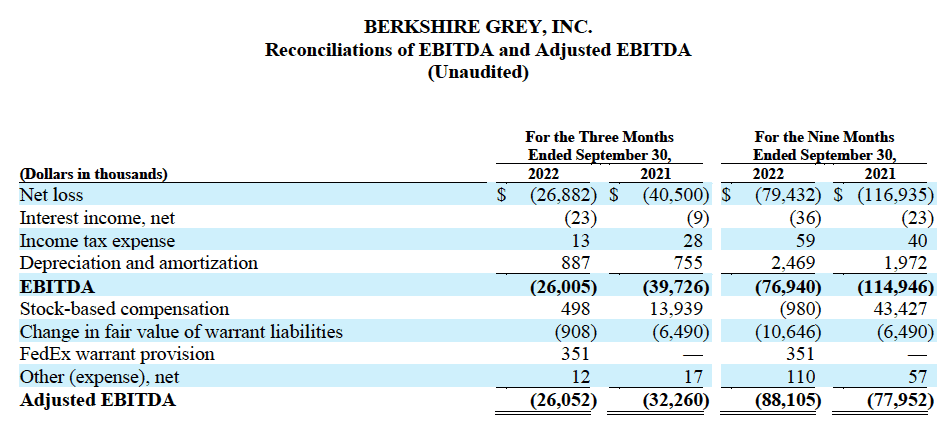

- Adjusted EBITDA of ($26.1) million.

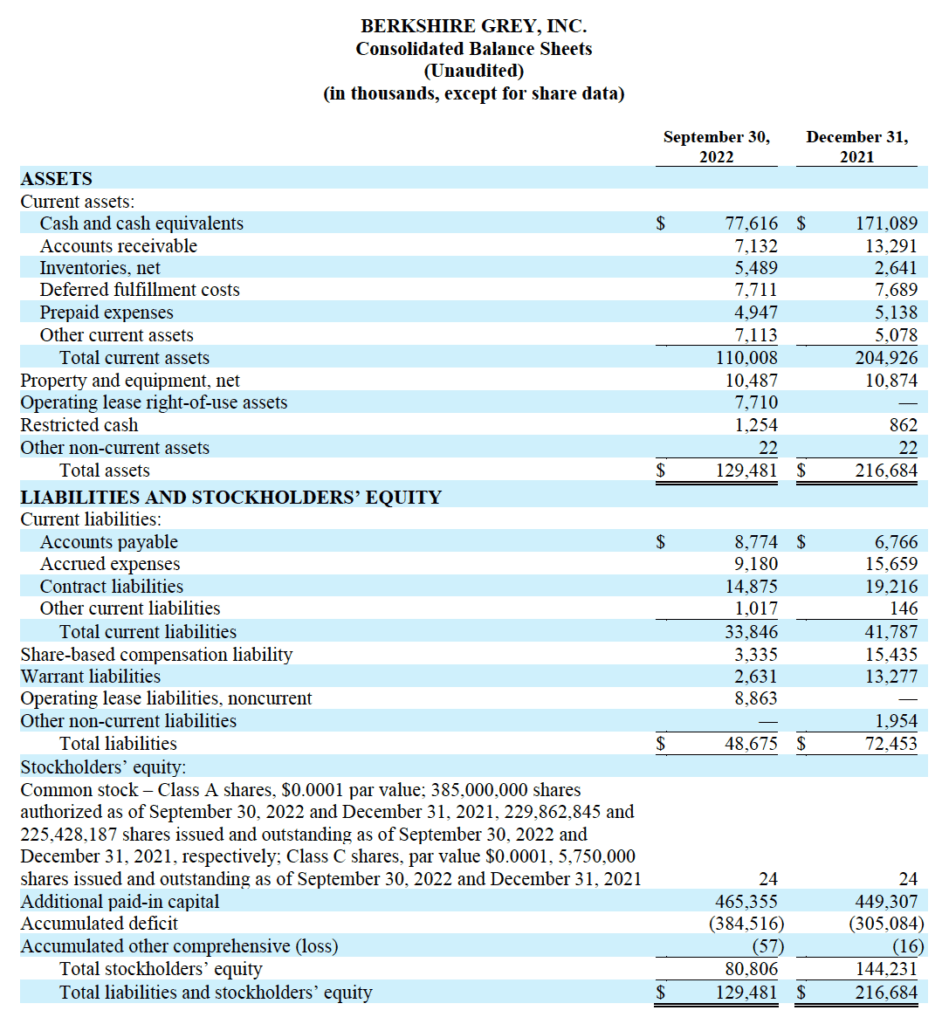

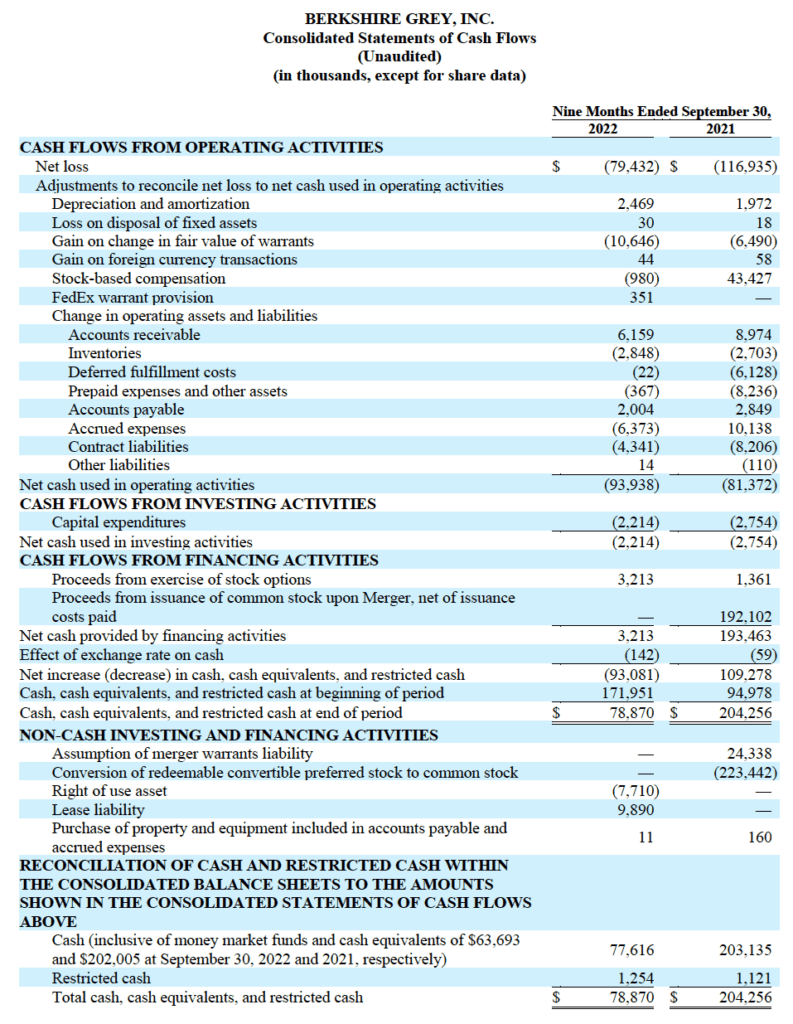

- Approximately $78 million of cash and cash equivalents with no debt as of September 30, 2022.

Recent Business Highlights

- Berkshire Grey strengthened its financial flexibility by entering into an equity purchase agreement with Lincoln Park Capital. The agreement allows the Company to raise up to $75 million in cash from the sale of additional common stock to Lincoln Park over a three-year term.

- Achieved record number of system installations during the quarter – installed 57 systems at 16 different project sites, marking a key execution milestone for Berkshire Grey.

- Expanded the Berkshire Grey Partner Alliance program to include 16 partners.

“The Berkshire Grey team executed well operationally in the third quarter,” said Tom Wagner, CEO of Berkshire Grey. “Revenues were strong, we secured new orders and deployed a record number of Berkshire Grey’s AI-enabled robotic solutions faster and more efficiently at customer sites than ever before. Further, we are making excellent progress towards improving our gross margins, which have been improving steadily throughout the year. We believe we are well positioned for continued growth into 2023 and beyond.”

Outlook for Full Year 2022

The Company now expects full-year 2022 revenue, excluding the impact of any provision for common stock warrants, in the range of $65-70 million. Prior guidance did not include any estimates for provisions for common stock warrants. The updated estimate for 2022 revenue reflects slight delays expected at certain customer sites for the remainder of this year.

Berkshire Grey’s statements about expected revenue are forward-looking and based on current expectations and our actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Information Regarding Forward-Looking Statements.”

Conference Call and Webcast Information

Berkshire Grey will hold a conference call and webcast today at 10:00 am ET to discuss its third-quarter 2022 results. The telephonic version of the call can be accessed by dialing:

Dial-in: 1-833-630-2125 or 1-412-317-1844

Conference ID: Berkshire Grey Q3 2022 Earnings Call

A live webcast (listen only) can be accessed on the events page of the investor relations section of the Berkshire Grey website https://ir.berkshiregrey.com/news-events.

The replay of the call will be accessible on the Company’s website at https://ir.berkshiregrey.com/ approximately two hours after the conclusion of the live event and accessible for twelve months.

About Berkshire Grey

Berkshire Grey (Nasdaq: BGRY) helps customers radically change the essential way they do business by delivering game-changing technology that combines AI and robotics to automate fulfillment, supply chain, and logistics operations. Berkshire Grey solutions are a fundamental engine of change that transform pick, pack, move, store, organize, and sort operations to deliver competitive advantage for enterprises serving today’s connected consumers. Berkshire Grey customers include Global 100 retailers and logistics service providers.

More information is available at www.berkshiregrey.com.

Non-GAAP Financial Measures

We define Adjusted EBITDA as net loss less other income or expense, income taxes, depreciation, and amortization expense, change in fair value of warrant liabilities, FedEx warrant provision, and stock-based compensation expense. In addition to our financial results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we believe that Adjusted EBITDA, a non-GAAP financial measure, is useful in evaluating the performance of our business. This non-GAAP measure has limitations as an analytical tool. We do not, nor do we suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors should also note that the non-GAAP financial measures we use may not be the same non-GAAP financial measures, and may not be calculated in the same manner, as that of other companies. We recommend that investors review the reconciliation of this non-GAAP measure to the most directly comparable GAAP financial measure provided in the financial statement tables included below in this press release, and not rely on any single financial measure to evaluate our business.

Cautionary Note Regarding Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this communication, including statements regarding Berkshire Grey’s beliefs regarding future operating performance, such as Berkshire Grey’s outlook and guidance for the full year 2022, the business collaboration between FedEx and Berkshire Grey and demand for Berkshire Grey’s solutions in general, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this communication are only predictions. Berkshire Grey has based these forward-looking statements on current information and management’s current expectations and beliefs. These forward-looking statements are subject to a number of significant risks and uncertainties, including, without limitation (a) current and future conditions in the global economy, including as a result of the impact of the COVID-19 pandemic, inflation and rising interest rates; (b) the loss of any customers, or the termination of existing contracts by any customers; (c) the inability to penetrate new markets and generate revenues from the pipeline; (d) demand for Berkshire Grey products and services from FedEx and other customers that does not grow as expected; (e) dependence on a limited number of third-party contract manufacturers; (f) the failure to manage any growth in the company or its business; (g) increased competition; (h) the difficulty of predicting order flow and revenue generated from Berkshire Grey’s small number of customers with generally large order sizes and many variables that can impact project schedules and the completion of sales; (i) risks associated with Berkshire Grey’s plans to develop and commercialize its product candidates to meet constantly evolving customer demands; (j) Berkshire Grey’s ability to maintain and establish collaborations or obtain additional funding; (k) other risks associated with companies, such as Berkshire Grey, that are engaged in the intelligent automation industry; and (l) other risks and uncertainties described under “Risk Factors” and elsewhere in the Company’s most recent Annual Report on Form 10-K filed with the SEC, and such other reports as Berkshire Grey has filed or may file with the SEC from time to time. Although such forward-looking statements have been made in good faith and are based on assumptions that Berkshire Grey believes to be reasonable, there is no assurance that the expected results will be achieved, and Berkshire Grey’s actual results may differ materially from the results discussed in forward-looking statements. Readers are cautioned not to place undue reliance upon any forward-looking statements. These forward-looking statements are made only as of the date hereof, and Berkshire Grey does not undertake any obligations to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

Investors: Ian Rhoades

Sharon Merrill Associate, Inc.

BGRY@investorrelations.com

Media: Method Communications for Berkshire Grey

berkshiregrey@methodcommunications.com

Get Started

with Berkshire Grey

Contact the BG Fulfillment Automation Sales Engineering Team to Learn How to:

- Reduce operations expense by up to 70%.

- Lessen your dependency on labor.

- Bolster facility throughput by up to 25% to 50% with automation.

- Get a customized ROI analysis of your specific environment and business.

Call +1 (833) 848-9900

or connect using our form.